London’s independent Nightlife Taskforce sets out comprehensive plan to drive the future of the capital at night

The report, by the independent industry-led Nightlife Taskforce, is the most comprehensive evidence-based assessment of London’s nightlife ever produced. It sets out the scale and importance of the capital’s nightlife and the challenges it faces, outlining 23 recommendations across 10 areas to protect, support and grow London’s vital nightlife industries.

Be part of a new chapter for Discover Children’s Story Centre

As part of its Up and Out building development project, Discover will be greening and growing with works designed to improve sustainability and accessibility. Discover has worked with award-winning architects, Jan Kattein, to create unique, innovative and beautifully designed spaces. Discover will reopen in mid- to late-May. In the meantime,…

Bus service changes from January 2026

This affects the frequency of services of some of the routes. For more information and to check for specific bus routes, visit the TFL website.

Have Your Say in Newham’s Future

Residents and businesses in Newham are invited to review the draft document and submit any comments until the 2nd of February 2026. To read more about the proposed budget you can follow the link.

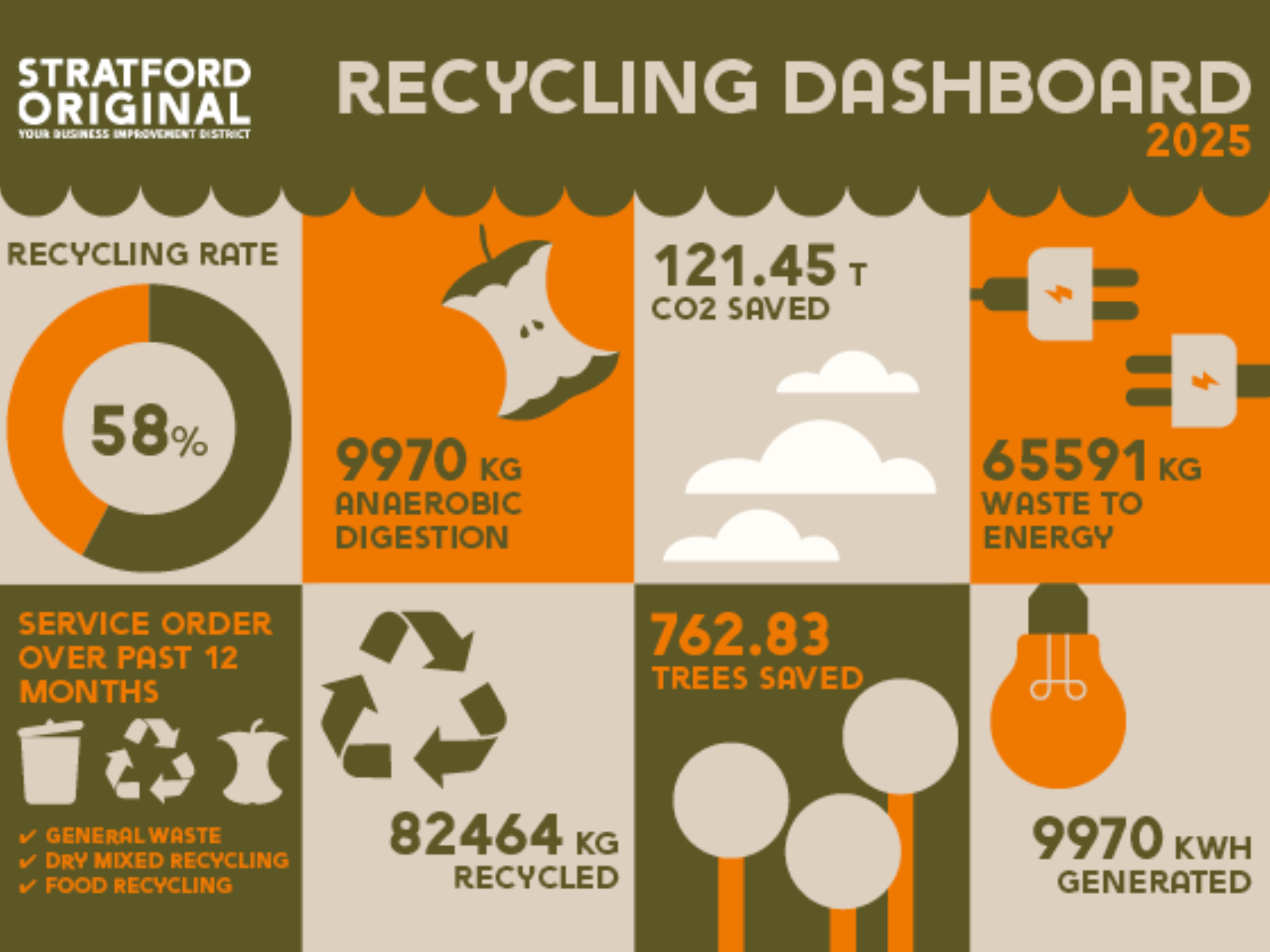

Annual Recycling Stats

This year we will be reviewing the services, aiming to increase the number of participatory businesses and positive impact we make.